Raya Holding Announces Raya Foods Secures $40 Million Investment from Helios Investment Partners to Expand Its Operations

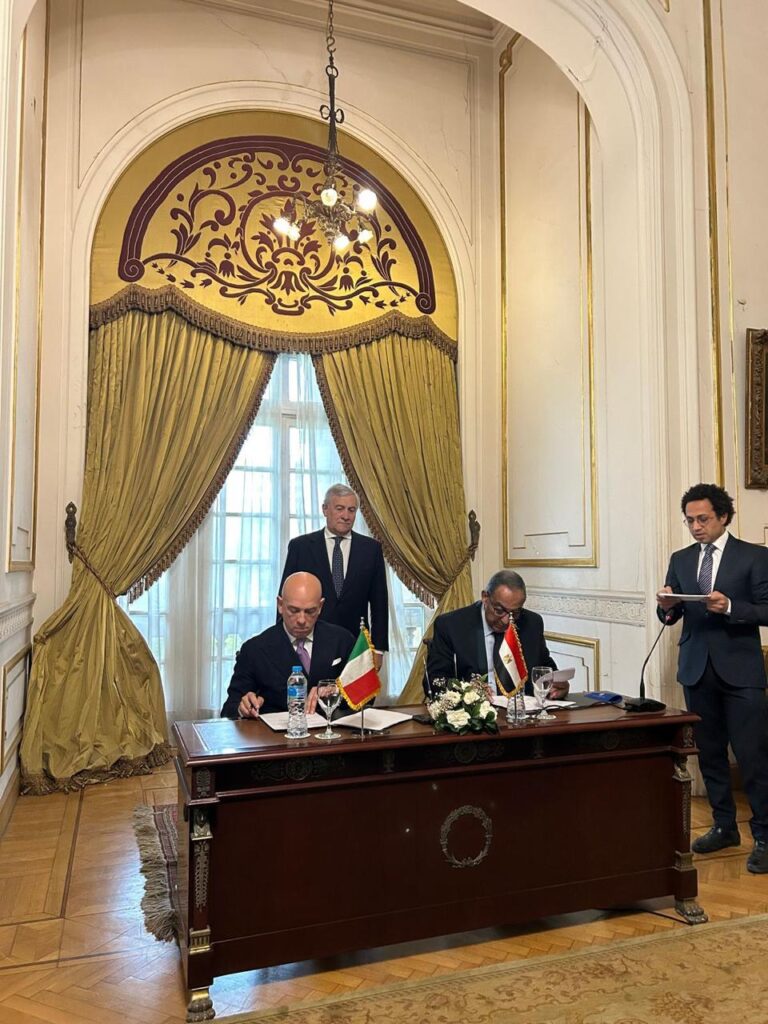

Home Service Funding Solutions Investment Partnership Engineering Consultancy Oil Products & Storage News Partners Clients Contact Home Service Funding Solutions Investment Partnership Engineering Consultancy Oil Products & Storage News Partners Clients Contact Request Appointment Linkedin-in Instagram Twitter Home Service Funding Solutions Investment Partnership Engineering Consultancy Oil Products & Storage News Partners Clients Contact Home Service Funding Solutions Investment Partnership Engineering Consultancy Oil Products & Storage News Partners Clients Contact Linkedin-in Instagram Raya Holding Announces Raya Foods Secures $40 Million Investment from Helios Investment Partners to Expand Its Operations Updated News Raya Holding Announces Raya Foods Secures $40 Million Investment from Helios Investment Partners to Expand Its Operations Read More September 7, 2025 In Cairo, Italy’s Foreign Minister and Ambassador signed a strategic agreement to finance Egyptian industrial projects with an initial €100 million for 2025. Read More April 27, 2025 Load More April 27, 2025 Raya Foods Go to Source Raya Holding for Financial Investments has announced an investment of approximately $40 million in its portfolio company, Raya Foods, in a deal led by Helios Investment Partners, Africa’s largest private equity firm with more than $3 billion in assets under management. The final investment amount will be confirmed upon closing. Through this transaction, Helios will acquire a 49% stake in Raya Foods, reinforcing their strategic partnership and supporting the company’s ambitious growth plans, with a focus on strengthening Egypt’s role in the global food sector. This investment will enable Raya Foods to expand its production capacity, advance its frozen food manufacturing capabilities, and scale exports to meet rising international demand. The company already exports to more than 50 countries, particularly across Europe and the United States. Currently the second-largest exporter of frozen fruits and vegetables in Egypt, Raya Foods is aiming to become the national leader and the first in the country to manufacture and export freeze-dried fruits and vegetables, in line with global trends toward healthy and sustainable food products. Ahmed Khalil, CEO of Raya Holding, expressed confidence in the deal, saying: “This strategic investment reflects investors’ trust in Raya Holding’s vision and our plans for future growth. It supports our objectives of boosting foreign currency revenues while reinforcing Raya Foods’ leadership in frozen food exports. With the addition of our new freeze-drying facility, the company will diversify its portfolio, increase capacity, and enhance its global presence. This deal also strengthens our performance on the Egyptian Stock Exchange and creates added value for our shareholders.” Omar Abdelaziz, CEO of Raya Foods, described the investment as a turning point for the company: “Securing $40 million in funding with Helios highlights the strong performance we have achieved over the past five years. We began as a small company and are now Egypt’s second-largest exporter of frozen fruits and vegetables, with an annual capacity of 50,000 tons. With our new factory dedicated to freeze-dried products, we are on track to become the country’s largest exporter. This investment will accelerate our international expansion, diversify our offerings, and increase our competitiveness in meeting global demand for healthier, sustainable food.” He added that in the first half of 2024, Raya Foods became Egypt’s largest exporter of frozen strawberries, and the company is determined to build on this success. Raed Barkatis, Head of Consumer and Healthcare at Helios Investment Partners, emphasized the value of the partnership: “We are excited to support Raya Foods’ growth and see this as an opportunity for mutual success. Raya Foods is a leader in Egypt’s frozen food sector, and this investment will enhance its production capabilities while opening doors to new global markets. With the growing worldwide demand for healthier foods, we believe this partnership will contribute to advancing agriculture, strengthening food security, and creating long-term value.” Through this collaboration, Raya Foods is positioned to reinforce its role as a global player in the healthy food and agricultural sectors. By offering innovative food solutions, supporting local farmers, generating foreign currency revenues, and expanding into new markets, the company aims to achieve sustainable growth while contributing positively to the Egyptian economy. Updated News Raya Holding Announces Raya Foods Secures $40 Million Investment from Helios Investment Partners to Expand Its Operations Read More September 7, 2025 In Cairo, Italy’s Foreign Minister and Ambassador signed a strategic agreement to finance Egyptian industrial projects with an initial €100 million for 2025. Read More April 27, 2025 Load More